Did you know that the average electric vehicle depreciates faster than its ICE counterpart? In recent years, electric vehicles (EVs) have become increasingly popular, crossing 56,207 units in July 2024 (CEEW Data), mainly driven by government incentives and rising fuel costs. However, a primary concern for potential EV buyers is depreciation – the decline in a vehicle’s value over time.

This comprehensive guide explains everything about electric vehicle depreciation, offering insights into factors affecting value, calculation methods, and strategies to minimize depreciation rates. By understanding these dynamics, you can make informed decisions about EV ownership.

The decline in the value of electric vehicles is faster than ICE vehicles is improving with the widespread EV adoption and technological advancements. Several factors affect the depreciation of EVs and, many factors help to minimize the depreciation which we will discuss in this ultimate guide.

Before going deep into the topics, let’s first understand the basics of EV depreciation.

What is the Depreciation of Electric Vehicles?

Electric Vehicle Depreciation is the decrease in an electric vehicle’s value over time, influenced by factors such as age, mileage, and technological advancements. Since EVs are very costly, understanding EV depreciation is important as it impacts the overall cost of ownership and determines the resale value of the EV.

For example, if a car has an annual depreciation value of 20%, its resale value will be reduced by 20% of the purchase cost in a year or some specific kilometers driven. Depreciation impacts both resale value and residual value, however, resale value keeps changing based on the market conditions, while residual value is the fixed value of the vehicle at the end of its lifespan.

Let’s have a look at the increase in the depreciation rate of electric vehicles to understand how much it impacts the resale value of an EV.

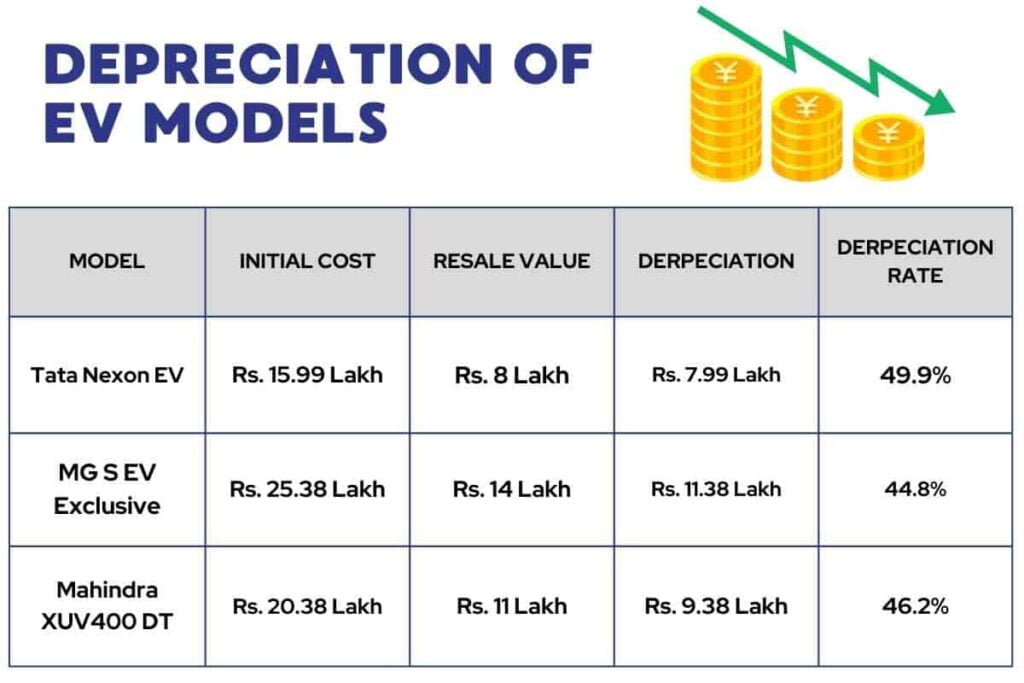

Depreciation of popular EV Models

To better understand the depreciation trend of EVs, let’s have a look at the depreciation rates of a few electric cars over 3 years:

| Model | Initial Price | Resale Value | Depreciation Amount | Depreciation Rate |

|---|---|---|---|---|

| Tata Nexon EV | Rs. 15.99 Lakh | Rs. 8 Lakh | Rs. 7.99 Lakh | 49.9% |

| MG S EV Exclusive | Rs. 25.38 Lakh | Rs. 14 Lakh | Rs. 11.38 Lakh | 44.8% |

| Mahindra XUV400 DT | Rs. 20.38 Lakh | Rs. 11 Lakh | Rs. 9.38 Lakh | 46.2% |

Currently, electric cars exhibit an average annual depreciation exceeding 20%. This data is derived from initial and second-hand prices listed on popular car websites such as Cardekho, Carwale, and Ecogears. The second-hand prices are collected from the trusted and popular resale price estimation website – Orangebook Value. The depreciation value and rate are calculated based on the formula mentioned below.

“I upgraded from my Tata Tiago EV to a newer model – Tata Punch EV 2024 with longer range. Selling the older car was easy. There was a decent demand for pre-owned EVs in my city. I was pleasantly surprised by the resale value of Rs. 8.2 Lakh, especially considering the government incentives I received when purchasing the car. The entire selling process was hassle-free.”

Ravi Singh, Tata Punch EV owner, (Delhi, July 2024)

To determine the depreciation value of an electric vehicle, it is important to understand the factors that impact the depreciation of electric vehicles. By recognizing these factors, one can make informed decisions when purchasing an electric vehicle.

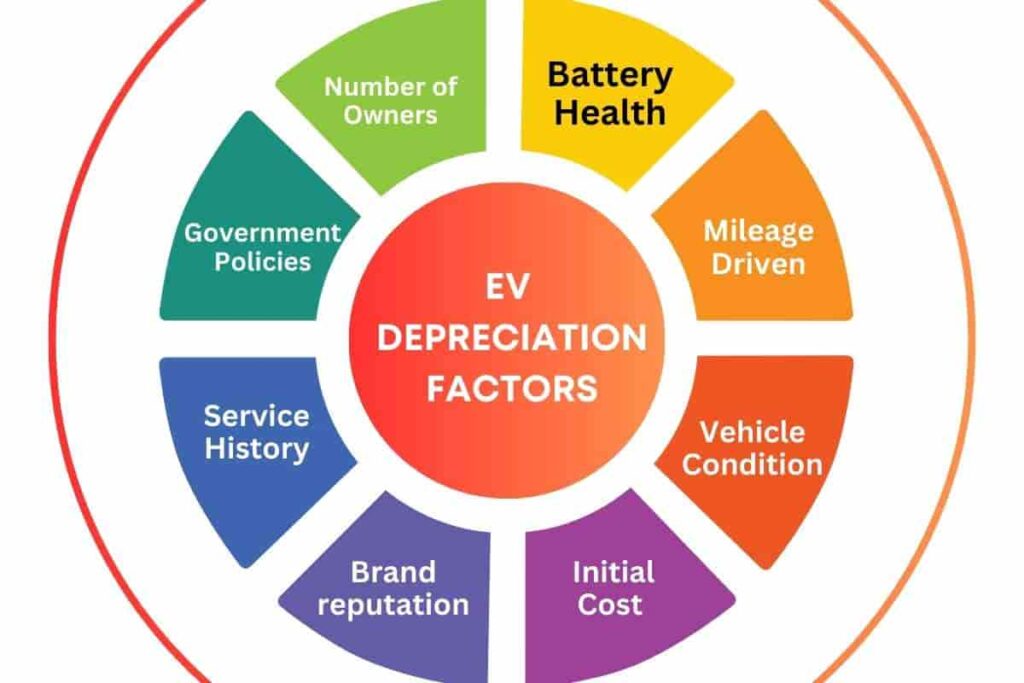

Factors Affecting Depreciation of Electric Vehicles

Here are all the important factors that affect the depreciation cost of electric vehicles, which would ultimately determine their resale value:

1. Battery Health

Battery health and remaining battery capacity are the key parameter that determines the depreciation rate of electric vehicles. For example, an electric car with good battery health and charge retention capacity offers a good range per charging cycle, hence it has a better resale value compared to an EV with poor battery and short ranges.

2. Mileage Driven

A significant factor influencing depreciation is the total mileage the car is driven. Generally, lower total mileage driven on the odometer means less wear and tear a vehicle has experienced, which equates to higher resale value. More mileage driven indicates the chances for more maintenance, thereby affecting the depreciation. However, a high mileage-driven EV in well-maintained condition might hold a lower depreciation and higher resale value.

3. Vehicle Condition

Along with the mileage it is important to maintain the overall vehicle’s condition. A low-maintained car in poor condition tends to have higher depreciation due to risks of higher maintenance. Meanwhile, electric vehicles in a well-maintained condition would have lower depreciation and higher resale value.

4. Initial Purchase Cost

Like any ICE vehicle, the depreciation of EVs too depends on the initial cost of the vehicle. Generally, higher-priced electric cars and scooters depreciate more due to their higher maintenance requirements, compared to budget-friendly EVs. Meaning that higher initial costs lead to a higher depreciation rate in the case of EVs.

5. Brand reputation and demand

A vehicle’s brand reputation and consumer demands are important factors affecting depreciation cost. Certain brands are known for their superior quality products, durability, and reliability which results in increased demands, causing lower depreciation rates and higher resale value. For example, electric cars from established brands like Tata have lower depreciation costs compared to recently launched startups like PMV motors.

6. EV Service History

A regularly serviced electric vehicle with records from authorized EV specific service centers is likely to have lower depreciation costs. Regular servicing from company authorized EV technicians ensures smooth maintenance of the complex machine, and provides assurance to the buyers, thereby having a lower depreciation cost.

7. Government Policies and Incentives

Phase-out of certain Government incentives offered on EV purchases might lead to a decrease in demand for older models, increasing the depreciation cost. Whereas, the availability of incentives reduces the overall cost of the vehicle lowering the depreciation rate.

8. Number of Owners

From a buyer’s perspective, the number of owners an EV has passed through is an influential factor in its depreciation value. EVs owned for a short period by several owners indicate problems in the vehicle, making buyers skeptical, which drastically increases the depreciation of the electric vehicle.

Nitin Bhandari, owner of a preowned electric cars dealership, suggests that “second-hand electric cars have lower depreciation value compared to third and fourth-hand cars, due to buyer perception” (16 February 2024, Delhi).

9. Technological Advancements

Being in the nascent stages of EV adoption, new EV models are constantly introduced in the market. New electric vehicles with advanced technology and enhanced performance can accelerate the depreciation of older models as they become less desirable compared to their newer counterparts.

Other factors affecting the depreciation rates of electric vehicles include the age of the vehicle, and market conditions (economic).

If you’re considering upgrading to a newer EV model, accurately assessing your current vehicle’s depreciation value is important. Understanding depreciation factors will empower you to negotiate a fair price when selling your existing electric car.

How to calculate the depreciation of Electric Vehicles?

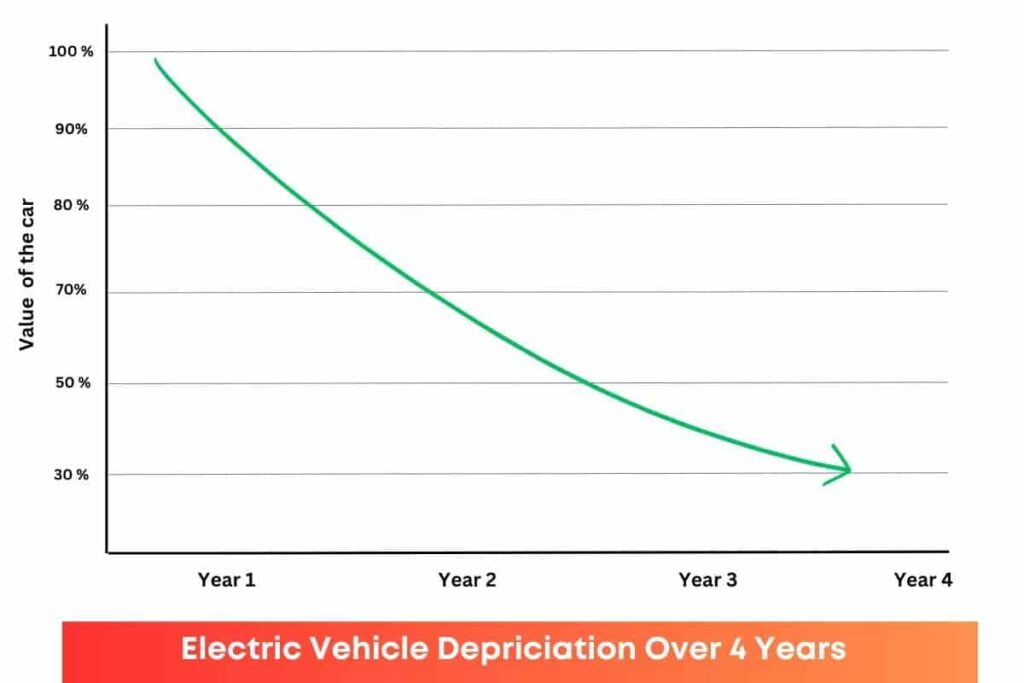

Depreciation rates vary across EV models and are primarily influenced by EV specific factors including battery health, technological advancements, and charging infrastructure. However, the basic principle to calculate the depreciation of EVs is based on the fact that the vehicle loses its value over time.

Generally, the rate of depreciation can be calculated using the simple formula:

- Depreciation Value = (Initial Cost of EV – Residual Value)

- Depreciation Rate = (Initial Cost of EV – Residual Value) / (Initial Cost of EV) X 100

Considerations:

- Residual value: This is the estimated value of the EV at the end of its lifespan. Factors like battery health, range driven and range per changing cycle, and future advancements in EV technology can significantly influence residual value.

- EV Specific considerations: Several factors specific to EVs should be considered while calculating the depreciation of electric vehicles such as battery degradation, model year, and latest EV technology.

- Example: Due to constantly evolving EV technology, budget-friendly electric cars with less advanced EV technology have rapid depreciation compared to high-end electric vehicles. Low consumer demand and the urge for better and upgraded technology affect its resale value.

In this evolving market, an EV owner needs to keep the car in a better condition to retain its resale value. Understanding ways to lower depreciation costs results in better resale values.

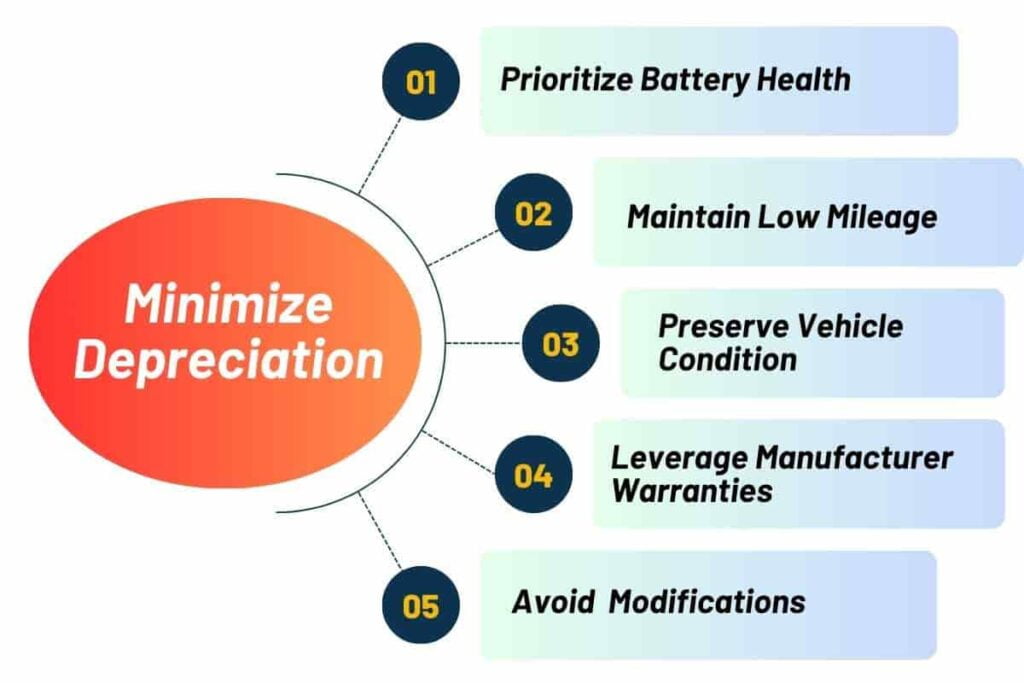

Ways to Minimize Depreciation of Electric Vehicles

Preserving the value of electric vehicles requires a good understanding of the current EV landscape and following some basic steps. Here’s how one can minimize the depreciation of electric vehicles:

- Prioritize Battery Health: Optimal battery care is crucial. Following manufacturer guidelines for EV charging, operating temperature, and driving modes can help retain the battery’s health and capacity.

- Maintain Low Mileage: While driving is the main purpose of any vehicle, excessive mileage on the odometer can negatively impact resale value.

- Preserve Vehicle Condition: Regular cleaning, both interior and exterior, and timely maintenance with a track record of the vehicle’s timely servicing, enhances the vehicle’s appeal to potential buyers.

- Leverage Manufacturer Warranties: EV manufacturers offer battery warranties up to a few years or kilometers driven. Selling an electric vehicle under that period or even with an extended warranty significantly minimizes depreciation.

- The right time to sell: Timing your sale strategically, such as during peak consumer demand periods, or before the launch of a newer model can significantly minimize depreciation.

- Avoid Excessive Modifications: Resisting the urge to heavily modify the electric vehicle can help retain its resale value and low depreciation. Most buyers prefer EVs with fewer modifications, since EVs have complex electrical systems, there’s always a chance of malfunction after local modifications.

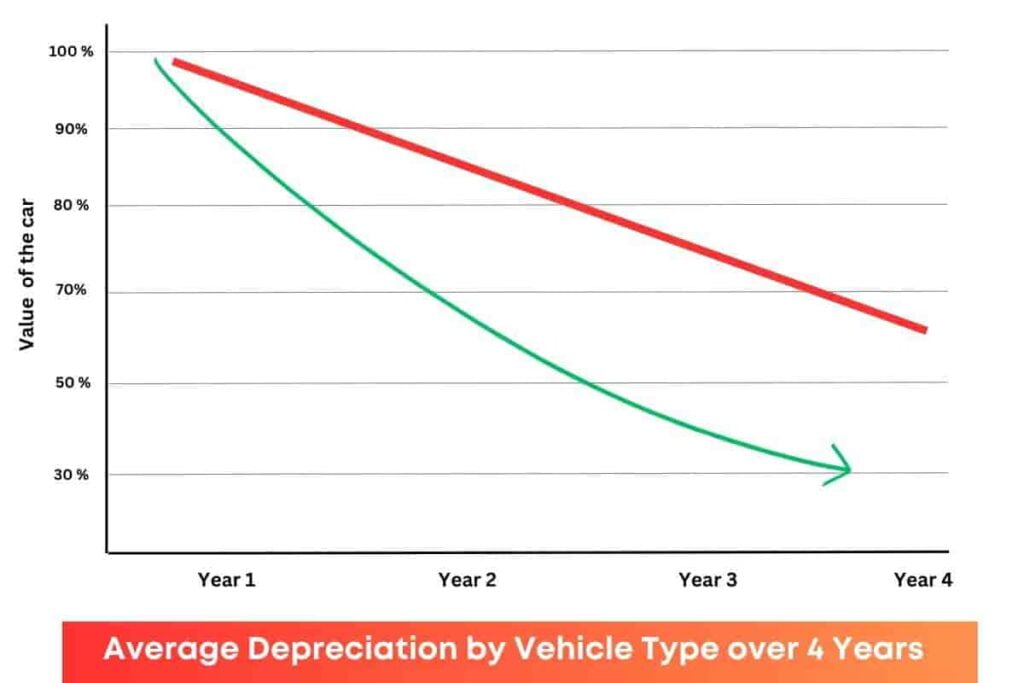

EV vs. Petrol/Diesel Vehicle Depreciation

EV depreciation is more complex than that of petrol or diesel vehicles, which tend to depreciate at a relatively predictable rate.

To understand how electric vehicles depreciate compared to petrol/diesel powered vehicles, let’s have a look at the trends in depreciation rates over 3 years:

For this comparison, we have considered the top-selling variant Tata Nexon EV Fearless, and its petrol counterpart Tata Nexon Fearless Plus S DT Diesel used for two years, both driven over 30,000 km over a year.

| Model | Initial Price | Second-Hand Price | Depreciation Amount | Depreciation Rate |

|---|---|---|---|---|

| Tata Nexon EV | Rs. 15.99 Lakh | Rs. 8 Lakh | Rs. 7.99 | 49.9% |

| Tata Nexon (Diesel) | Rs. 15 Lakh | Rs. 8.7 Lakh | Rs. 6.3 Lakh | 42% |

It is clear from the table above that the depreciation rate of electric vehicles is faster than petrol/diesel cars due to concerns about battery degradation and limited range.

However, this graph is changing with the launch of newer EV models with longer ranges and more advanced battery technology that are holding the depreciation value better.

Additionally, government incentives, improvement in the nationwide EV charging infrastructure, and the increasing popularity of EVs are also contributing to slower depreciation rates.

An electric vehicle’s value depreciates over time, influencing financial aspects. Depreciation impacts loan terms and interest rates, as lenders assess the car’s future worth. While insurance premiums aren’t directly tied to depreciation, the vehicle’s insured value decreases, affecting coverage. Understanding these dynamics is crucial for making informed financial decisions as an EV owner.

Impact on EV Financing and Insurance

Depreciation substantially influences electric vehicle financing and insurance coverage. A higher depreciation value of a vehicle often leads to stricter loan terms, while a lower depreciation value can offer more favorable options.

While depreciation doesn’t directly affect insurance premiums, it does impact the insured value of the vehicle. As the EV depreciates, its coverage amount decreases. Some insurance companies offer EV-specific plans considering factors like battery life, and technological advancements.

Vignesh Rathi, an Automobile loan advisor, Federal Bank, stated that, “From a financial perspective, treating an EVs as a long-term investment is crucial. Factors like residual value and potential tax benefits should be considered when making purchasing decisions.”

Understanding this relationship between EV depreciation and financing helps EV owners make informed financial decisions.

Future Trends for EV Depreciation

The current rate of EV depreciation is due to several factors like limited models, evolving battery technology, and developing charging infrastructure. However, the landscape is expected to change dramatically in the coming years. Here are some expected future trends in the depreciation of electric vehicles:

- Impact of battery technology: Advancements in battery technology, such as increased range, longer charging cycles, and faster charging capabilities, will significantly impact EV depreciation. As batteries improve, their value retention will likely increase, slowing down the depreciation rate. Ola CEO, Bhavish Agarwal, said in an interview with ecogears, “Battery technology is evolving rapidly. As battery life and performance improve, we can expect to see slower depreciation rates for electric vehicles.”

- Market growth and competition: A wider range of EV models entering the market will intensify competition and, potentially affect resale values.

- Government policies: Government policies, including changes in purchase subsidies or charging infrastructure development, will play a crucial role in shaping EV depreciation trends. For example, increased charging infrastructure could boost EV demand and potentially slow down depreciation.

Considering these expected future trends, it’s predicted that EV resale values will improve over time. As battery technology improves and consumer confidence in EVs grows, depreciation rates are expected to stabilize and even decrease in comparison to petrol/diesel vehicles.

Conclusion

Understanding EV depreciation is crucial for making informed decisions as an electric vehicle owner. By knowing the factors influencing depreciation, including battery health, mileage, vehicle condition, and market trends, you can better predict a car’s resale value and plan your finances accordingly. While depreciation is inevitable, taking steps to maintain electric vehicle’s condition and strategic sale timings can help minimize the rate of depreciation.

Owning an electric vehicle is a long-term commitment, and understanding depreciation is a key part of that journey. By understanding these factors and implementing the strategies to minimize depreciation, you can protect your investment in EVs and enjoy the benefits of electric vehicle ownership.”

FAQs

Electric vehicles (EVs) have a depreciation rate of around 22% annually, according to a recent market analysis. This is lower than the official government approved rate of 40%. However, the overall depreciation rate during resale can reach approximately 47% over a few years.

Electric vehicles (EVs) with lower initial costs, excellent condition, fewer previous owners, and lower mileage tend to depreciate less. Factors like battery health, brand reputation, and technological advancements also influence depreciation rates. Popular models known for value retention include the Tesla Model 3, Porsche Taycan, and Volkswagen ID Buzz.